Insights in Taxation and Policy: Highlights from the 12th MannheimTaxation Annual Conference

In September 2025, the twelfth international MannheimTaxation Annual Conference took place, bringing together more than 90 participants from around the world to discuss cutting-edge research in taxation. Over the course of two days, twelve presentation sessions and two poster sessions showcased a wide range of empirical and theoretical work in tax research.

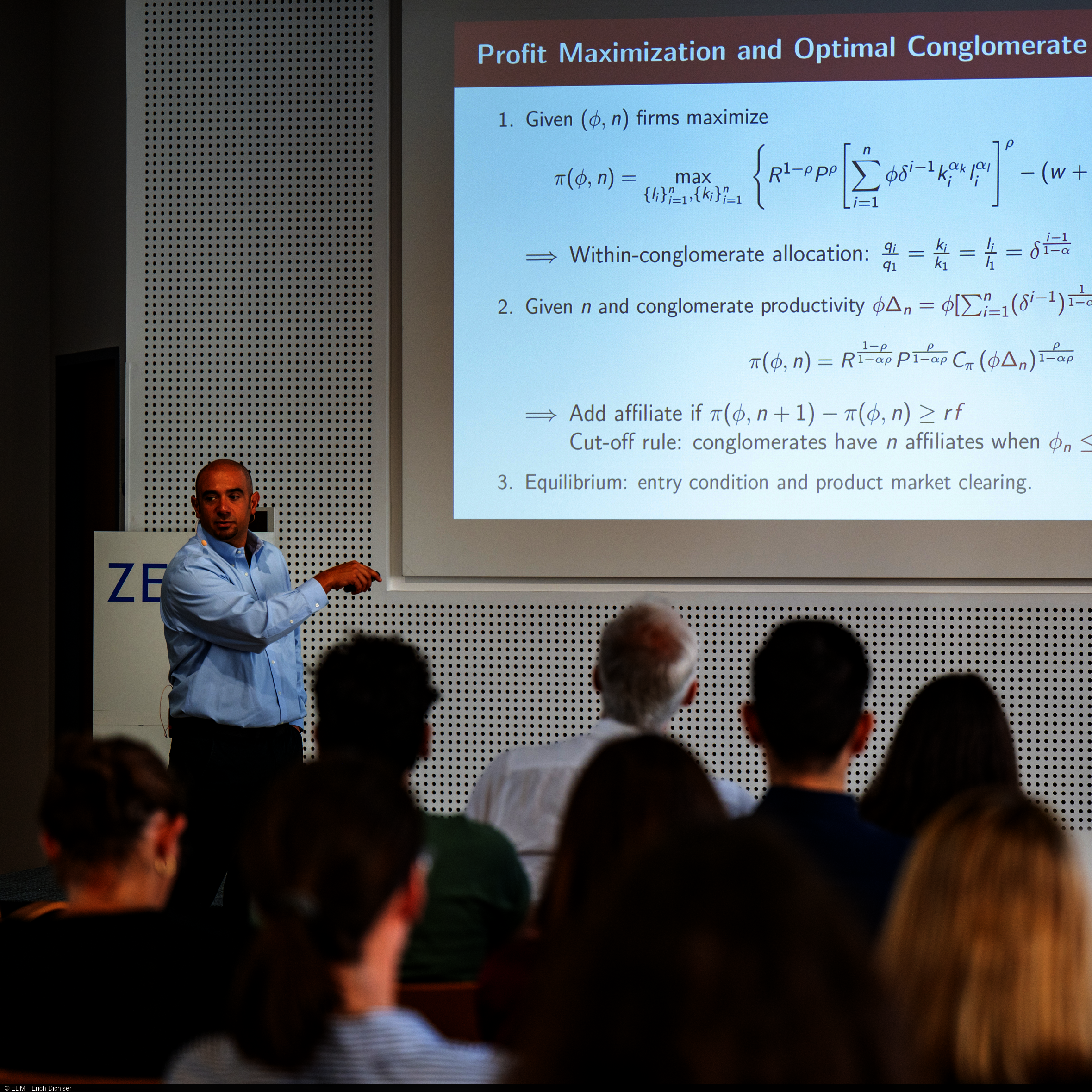

This year’s keynote speakers were Leslie Robinson from the Tuck School of Business, Dartmouth College, USA, and Juan Carlos Suárez Serrato from the Stanford Graduate School of Business, USA.

Leslie Robinson gave a keynote titled “Shaking Giants: The Slow Art of Challenging the Status Quo.” She reflected on the discomfort and persistence required to question long-standing conventions in academic research, drawing on her own experience revisiting widely used measures of multinational firms’ foreign income. Her work, co-authored with Jennifer Blouin, highlights substantial data misinterpretations in prominent studies on profit shifting and emphasizes the importance of carefully understanding financial reporting standards.

Juan Carlos Suárez Serrato presented his recent work titled “The Equilibrium Effects of Environmental Regulations: A Structural and Event Study Approach.” In his keynote, he highlighted how combining empirical and structural approaches can yield deeper insights into the analysis of spillover effects and the broader equilibrium effects of policy interventions. Quantifying these effects is crucial when designing policies to address major economic and societal challenges such as climate change.